"Intel is a national asset. This company needs to be healthy for the technology industry and for America" - Pat Gelsinger (Soon to be former CEO of Intel)

Intel Corporation presents a compelling investment opportunity due to its leadership in the semiconductor industry, its innovative roadmap, and significant support from the U.S. government. Historically, Intel has been a pioneer in technology, developing foundational computing components like the 486 microprocessor and continuing to innovate in areas such as AI, advanced packaging, and next-generation transistor technologies

A key factor in Intel's potential is its strategic alignment with U.S. governmental initiatives. As the only major American semiconductor manufacturer with in-house production, Intel is seen as vital to national security and technological sovereignty. The U.S. CHIPS Act, designed to revitalize domestic semiconductor manufacturing, includes billions in subsidies for companies like Intel to expand capacity and support innovation

Intel’s investments in cutting-edge manufacturing, such as its "five nodes in four years" initiative, aim to reclaim leadership from competitors like TSMC. This, coupled with partnerships with global tech leaders and its foundry business expansion, positions Intel for substantial growth in high-demand markets

Its strong historical brand, government backing, and ambitious strategy in a high-tech industry make Intel a potentially attractive choice for investors seeking to capitalize on the semiconductor sector’s rapid growth.

Valuation

Price to sales of 1.75 is below 5-Year Avg 2.62

This stock is selling for more than 30% below its 5 year average P/S ratio, currently selling at a strong discount relative to how the market has valued it historically.

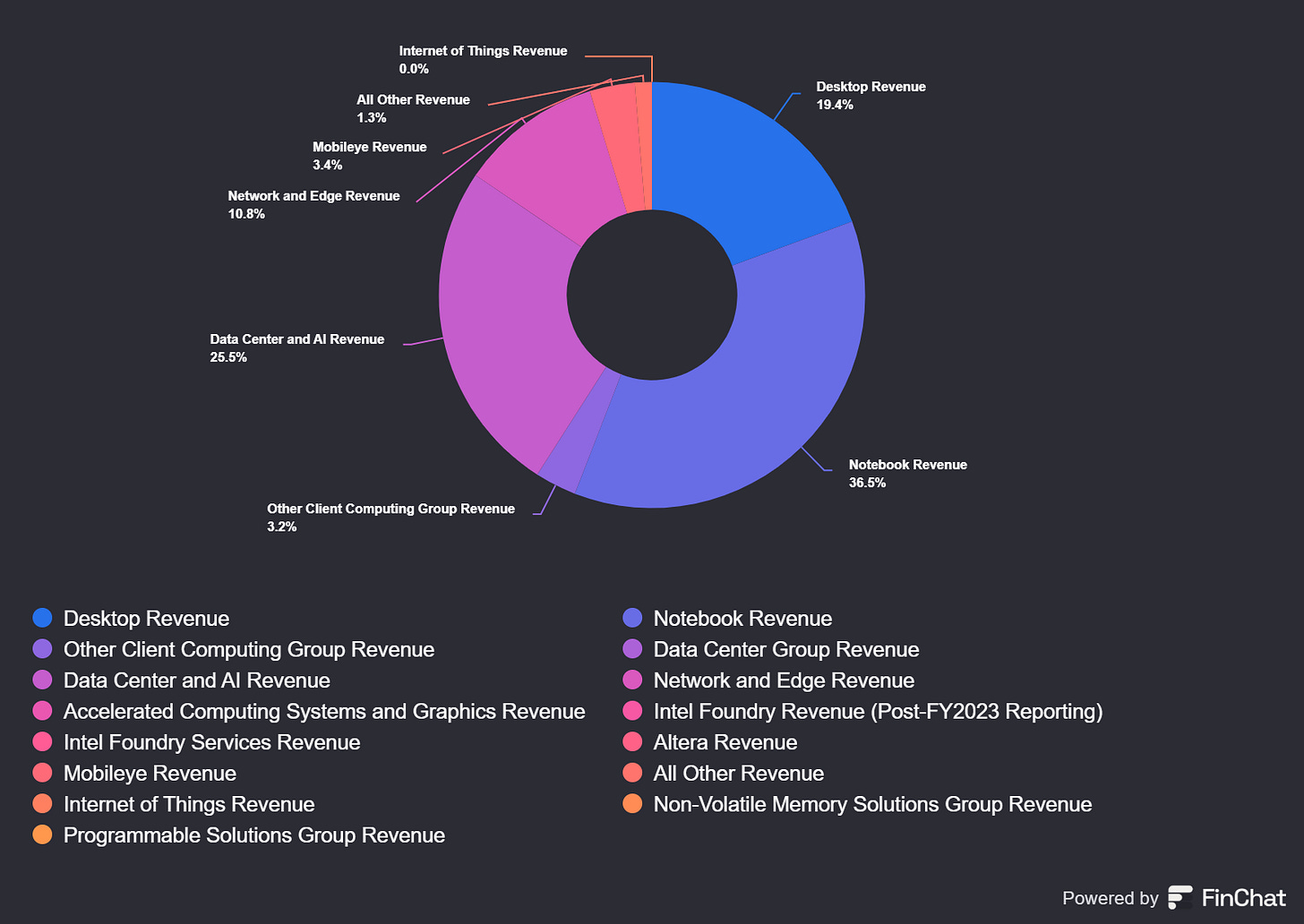

Revenue Segments

Notebook and desktop still take up majority of revenue but the data center and AI segment is where the growth has opportunity

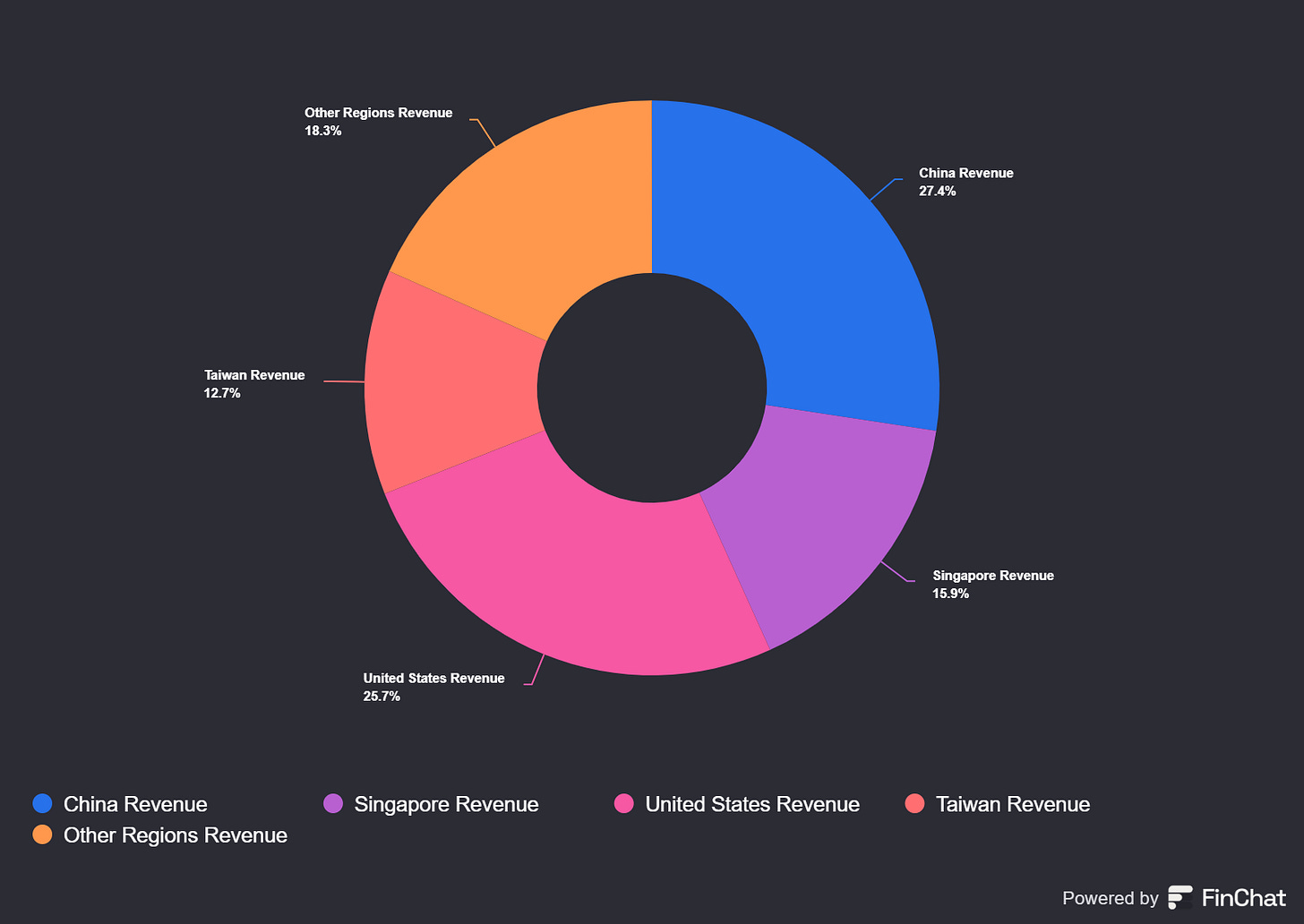

Here is another compelling call out, look at the revenue breakdown by region and what stands out?

China contributes a huge portion of revenue for Intel, can a recovering Chinese economy start to get priced in? If you wait to invest in China or any economy before a deep recession is over, the big profits are often missed. The market is efficient in sniffing out recoveries and starts pricing them in far before the news improves. Look at 2008 and 2020, the market sniffed out recovery and the money rolled in before the good news came. Companies with exposure to China such as

Intel can potentially see this as well soon enough.

Leadership Change

With Intel CEO Pat Gelsinger stepping down, potential successors include interim Co-CEOs David Zinsner and Michelle Johnston Holthaus. Zinsner brings extensive financial and operational expertise in semiconductors, having served as Intel's CFO and previously in leadership roles at Micron and Analog Devices. Holthaus, with decades at Intel, has led major divisions, including sales and client computing.

A leadership change could offer new strategic insights to accelerate Intel's turnaround, focusing on innovation, AI, and manufacturing efficiency. This may improve investor confidence and stock performance depending on execution

Investments have been made, time to execute

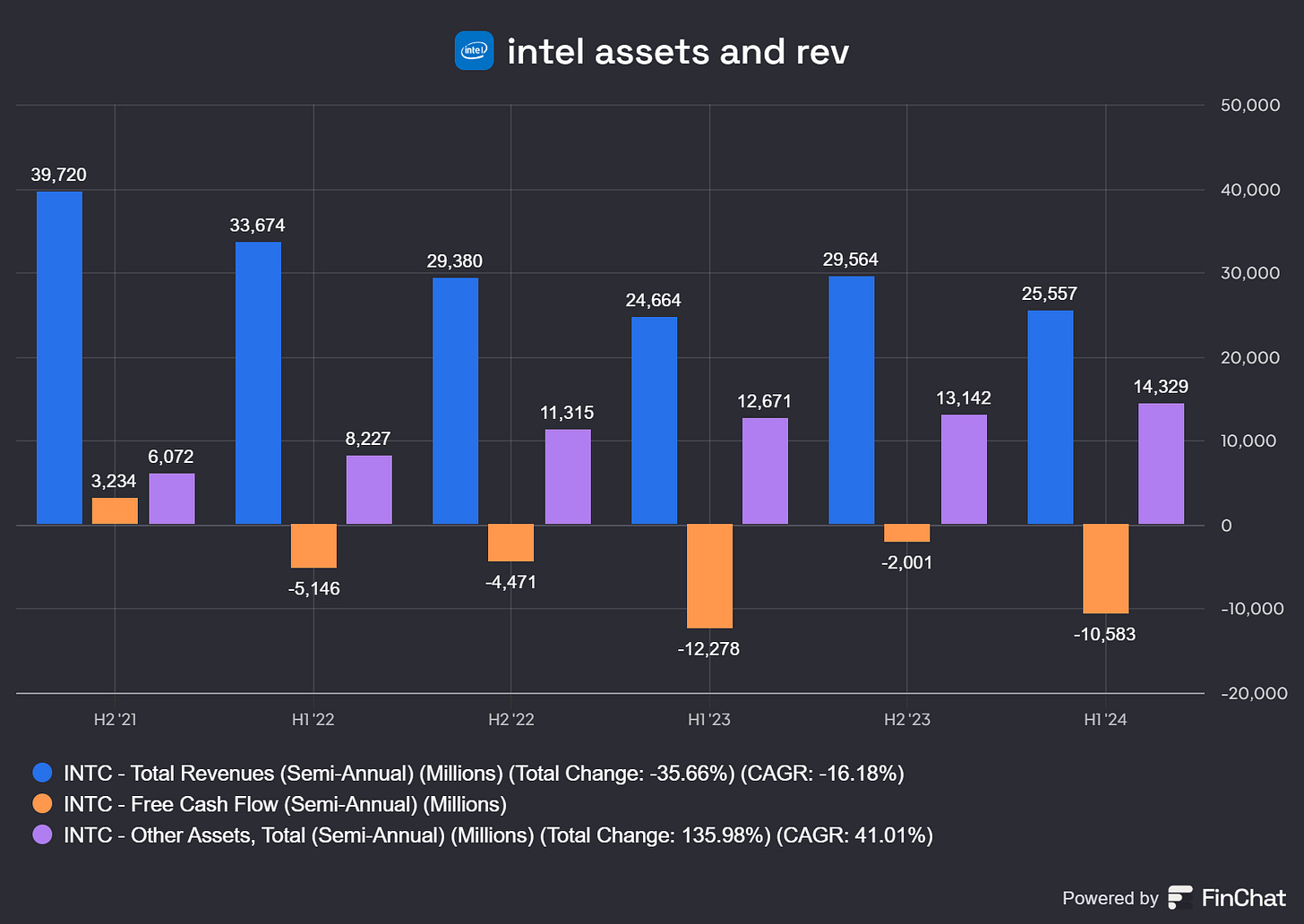

The increase in Intel’s assets, despite a decline in free cash flow, underscores a strategic shift toward long-term growth and innovation. This is primarily driven by reinvestment in its fabrication facilities (fabs), which are critical to its ambitions of reclaiming leadership in semiconductor manufacturing and expanding its foundry services business.

Benefits of Asset Growth Through Fab Investments:

Strengthened Competitive Position:

By investing heavily in advanced manufacturing technologies like Extreme Ultraviolet Lithography (EUV) and its “five nodes in four years” initiative, Intel is positioning itself to close the gap with competitors like TSMC and Samsung. These assets enhance Intel’s capacity to produce cutting-edge chips, attracting high-profile customers and supporting future revenue growthIncreased Strategic Importance:

Intel's fabs are vital to U.S. technology leadership, making the company a key beneficiary of government incentives under the CHIPS Act. These assets are not only a business advantage but also a national priority, ensuring supply chain resilience and technological sovereigntyScaling Foundry Services:

Intel’s fab investments enable it to diversify into foundry services, manufacturing chips for other companies. This strategy allows it to tap into the growing demand for semiconductor manufacturing capacity, expanding its addressable market and creating a potential high-margin revenue stream in the future

Long-Term Shareholder Value:

While free cash flow may decline in the short term, these investments in physical and intellectual assets increase the intrinsic value of the company. Over time, the enhanced manufacturing capabilities could lead to higher margins, robust revenue streams, and improved shareholder returns as market demand aligns with Intel’s capacity.

This strategy reflects Intel’s focus on future-proofing its business, embracing short-term sacrifice in profitability to secure long-term dominance in a highly competitive and strategically vital industry.

Technicals and Targets

I like the volume from the August / September monthly candles, a bit of a capitulation look.

Intel is a compelling investment at these levels while the story is still negative, a new CEO, and the US behind it to continue fueling growth, the time is now to start scaling in a position.

INTC 0.00%↑ shares currently trade just under $22, with valuation currently well below historical levels, buying now down to $18 level support with a 1st target of $40 near the 50D on the monthly.

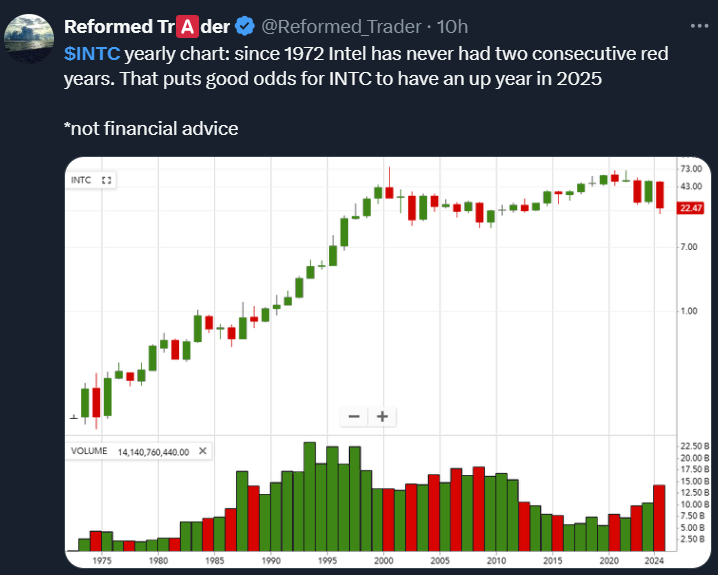

For icing on the cake check out this chart from one of the best traders out there

Disclaimer

The information provided is for informational purposes only and should not be considered as financial or investment recommendations.